Why Middle Market Companies Are a Hidden Goldmine

Jan 16, 2026

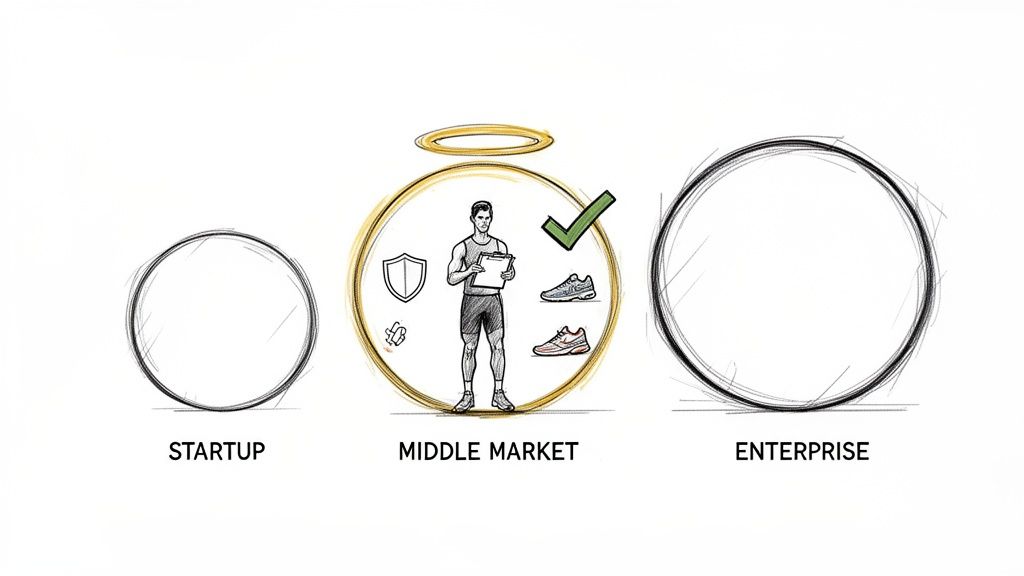

Middle market companies are the powerful, often-overlooked engine of the economy. They’re uniquely positioned between scrappy startups and corporate giants, creating a genuine ‘goldilocks zone’ for strategic partners looking for growth.

The Untapped Power of Middle Market Companies

Think of them like a promising athlete who has outgrown local competitions but isn't quite ready for the global stage. They have the talent and a solid foundation, but they need specialised coaching and better equipment to make that next leap. That's the middle market in a nutshell: stable enough to invest in real solutions but agile enough to adopt them without the bureaucratic drag of a massive enterprise.

These companies truly are the backbone of modern economies. Across the European Single Market, small and medium-sized enterprises (SMEs)—a category that includes this segment—make up over 99% of all 32.3 million businesses. A surprising 8% of these, which is about 2.6 million firms, fit squarely in the lower mid-market category. It’s a huge segment that often flies under the radar.

More Than Just Numbers

Defining these companies by revenue alone completely misses the point. Their real identity is found in their shared challenges and ambitions. These are businesses wrestling with scaling their operations, putting formal processes in place, and fighting for market share against much bigger, better-resourced competitors.

Middle market companies are at a critical inflection point. They’ve proven their business model and are ready to grow fast, but they're often held back by the very tools and processes that got them this far.

This creates a serious need for sophisticated, efficient solutions that can give them a competitive edge. They're actively looking for ways to improve their digital products, understand their customers on a deeper level, and make data-driven decisions—all without the expense of an enterprise-level research department. One practical recommendation is to implement a structured feedback loop. You can learn more about how to capture customer insights effectively in our guide to Voice of the Customer strategies.

To help clarify where these companies sit, this table breaks down the key differences between them, small businesses, and large enterprises.

Middle Market Companies at a Glance

Characteristic | Small Business | Middle Market Company | Large Enterprise |

|---|---|---|---|

Annual Revenue | < €10M | €10M – €1B | > €1B |

Employee Count | < 50 | 50 – 1,000 | 1,000+ |

Decision-Making | Founder-led, fast | Department heads, committee-based | Complex, multi-layered, slow |

Tech Stack | Off-the-shelf tools | Mix of custom & SaaS solutions | Highly customised, integrated systems |

Growth Focus | Survival, market entry | Scaling, market expansion | Market leadership, optimisation |

Biggest Challenge | Limited resources | Scaling pain, process formalisation | Bureaucracy, slow innovation |

As you can see, the middle market occupies a distinct space. They have moved past the survival stage but haven't yet taken on the institutional weight of a corporate giant, making them a unique and valuable segment.

The Ideal Partner for Growth

For product and UX teams, this is a prime audience. Unlike startups with shaky budgets, middle market companies have the capital to invest in tools that deliver a clear return. And unlike enterprises with year-long procurement cycles, they can make decisions and implement new platforms with refreshing speed.

This makes them ideal partners for a solution like Uxia. We provide enterprise-grade insights at a speed and scale that fits their needs perfectly, helping them turn that raw potential into measurable performance.

The Unique Pains and Pressures of Scaling Up

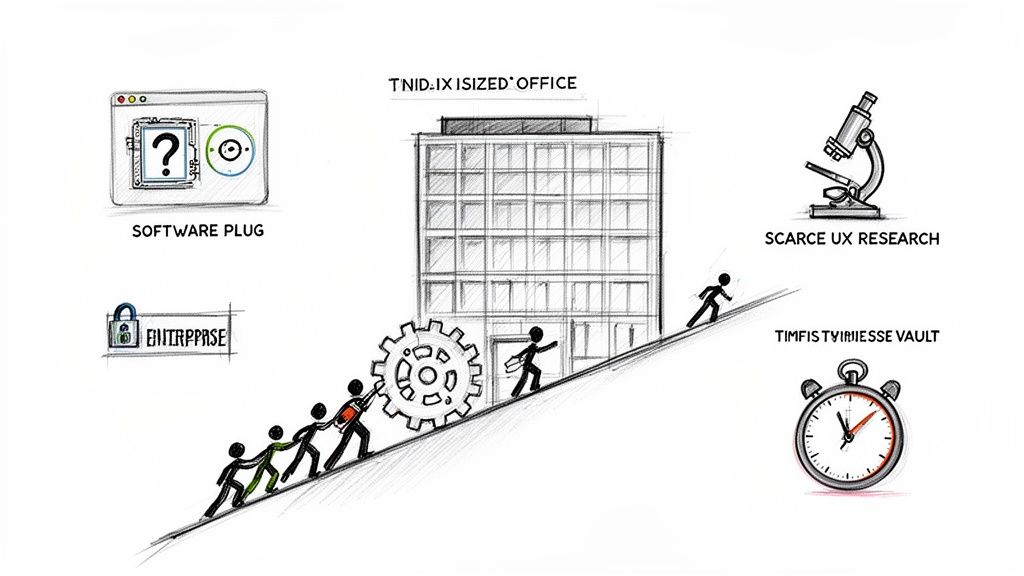

While middle market companies have successfully climbed out of the startup phase, their journey is anything but comfortable. They live in a tough middle ground, facing a unique set of ‘growing pains’ that smaller businesses and giant corporations just don’t experience. It’s a constant balancing act between ambition and the resources available to achieve it.

Let’s imagine a mid-sized e-commerce business—we’ll call them "Urban Homeware." They’ve built a loyal customer base with a patchwork of off-the-shelf software handling everything from inventory to marketing. But now, that growth is hitting a wall. Their systems can't keep up with order volume, and they certainly don't offer the deep data insights needed to personalise the customer experience.

The Problem of the Middle Ground

Urban Homeware is stuck. They’ve clearly outgrown their basic tools, but the jump to enterprise-level platforms is a financial chasm they can't cross. Those solutions come with six-figure price tags and demand dedicated teams to manage them—luxuries the company simply can’t afford right now.

This is the classic middle market dilemma. Teams are stretched thin, with people often wearing multiple hats. A marketing manager might double as the de facto product owner, while the small tech team is swamped just keeping the lights on, not pioneering new R&D.

The core challenge for middle market companies isn't a lack of vision; it's a lack of specialised resources to execute that vision at scale. They know what they need to do but are often held back by budget, time, and headcount.

This resource scarcity directly kneecaps their ability to compete. They watch larger rivals roll out slick new features and flawless user experiences while they're stuck making painful compromises. Every pound spent on one initiative is a pound taken from another, forcing them into tough choices between a new marketing campaign and a critical back-end upgrade.

Common Hurdles on the Path to Growth

This daily struggle shows up in several key areas that consistently slow down companies like Urban Homeware:

Limited Specialised Teams: A dedicated UX research department is a rarity. Product decisions often rely on gut feelings or a handful of customer emails, not structured user testing, which can lead to expensive mistakes down the road.

Complex Procurement: Unlike a startup founder who can make a quick call, buying new software involves multiple stakeholders—department heads, finance teams, you name it. The whole process becomes slower and more formal.

Pressure to Innovate: To stay in the game, they have to constantly improve their digital products. But without a formal R&D budget, innovation often becomes a side project instead of a strategic priority.

For Urban Homeware, this means that much-needed website redesign gets pushed back again and again. They know a better user experience would boost conversions, but they lack the budget for proper user testing and don't have the in-house expertise to run it efficiently. This is exactly where a tool like Uxia becomes a game-changer.

By delivering fast, affordable, and reliable user feedback, Uxia helps bridge that resource gap. A practical recommendation is to start by testing the most critical user flow—like checkout or sign-up—to get immediate, high-impact insights. To make those improvements count, it's vital to know how to apply those insights, a topic we cover in our guide on implementing data-driven design.

Ultimately, these very pressures make middle market companies the perfect candidates for solutions that deliver expertise and efficiency right out of the box.

Why Your Product Team Should Target the Middle Market

When product teams hunt for growth, they often look at two extremes: scrappy start-ups or colossal enterprises. But tucked in between is a massive, often-overlooked opportunity: the middle market. These companies are hungry for a competitive edge and are far more open to new tools than their slow-moving corporate cousins.

Frankly, they're the ideal partners for innovative products.

First off, middle market companies actually have a budget. Unlike early-stage start-ups running on fumes, they have the capital to invest in solutions that deliver a clear ROI. But here’s the best part: their decision-making is refreshingly direct. You can often get straight to the key stakeholders without wading through endless layers of corporate red tape, which means shorter and more efficient sales cycles.

This accessibility is matched by a genuine, urgent need. These businesses are hitting a ceiling where off-the-shelf software just doesn't cut it anymore. They are actively searching for more sophisticated tools to streamline operations, sharpen their customer experience, and scale without breaking. Once your team locks onto the middle market, success comes down to building a robust B2B go-to-market strategy that speaks directly to these pain points.

From a Simple Solution to a Strategic Asset

Your product can be more than just a tool that solves an immediate problem; it can become a core part of their long-term strategy, especially when it comes to company valuation and M&A (mergers and acquisitions). A well-designed digital product, backed by solid UX data from a platform like Uxia, directly pumps up a company’s worth and makes it a much shinier target for potential buyers.

By providing a tool that demonstrably improves user engagement and conversion rates, you are not just selling software. You are delivering a tangible asset that contributes directly to their bottom line and future exit potential.

This is a huge deal in the current economic climate. Recent analyses show European mid-market M&A has remained remarkably stable, with software and IT services fetching the highest prices. This resilience signals an urgency for companies to perfect their digital products, and a platform like Uxia delivers the critical user insights they need to do just that.

The Ideal Customer Profile

Targeting middle market companies puts you in a unique sweet spot. Here’s a quick rundown of why they make such great customers:

Real Budgets: They have the cash to pay for valuable solutions without the extreme price sensitivity you find in smaller businesses.

Urgent Needs: They’re actively feeling the growing pains and are highly motivated to find tools that will help them scale efficiently.

Direct Access to Decision-Makers: Sales cycles are shorter because you can connect directly with the people who hold the purse strings and feel the pain.

Agile Enough to Adopt: They’re nimble enough to implement new software without the year-long integration death marches common in large enterprises.

By aligning your product's value with their strategic goals—like boosting their valuation—you stop being a vendor and start being an indispensable partner on their growth journey. A practical recommendation is to leverage a platform like Uxia to validate product-market fit in record time, turning their digital assets into their most powerful ones.

A Practical Guide to Navigating Their Buying Process

Trying to sell to middle market companies? Throw out the playbook you use for start-ups and enterprises. Their buying process is a unique hybrid, mixing formal evaluation with a heavy dose of personal trust. It’s less about rigid sales cycles and more about proving immediate, tangible value to a surprisingly small group of decision-makers.

Think about it this way: you’re not dealing with a lone founder who makes a gut decision, nor are you facing a faceless corporate procurement department. Instead, you'll find the buying committee is accessible but has many different voices. You're likely to see a mix of C-suite executives, hands-on department heads, and the actual managers who will live with your solution day-to-day. Each one has their own agenda.

Understanding the Key Players

To get anywhere, you have to speak to each person's specific worries. The CFO is looking for a clear, quantifiable return on investment (ROI), full stop. Meanwhile, the Head of Product is laser-focused on fixing operational bottlenecks that are slowing them down. And the end-user? The product manager? They just want a tool that isn’t a pain to set up and actually makes their job easier.

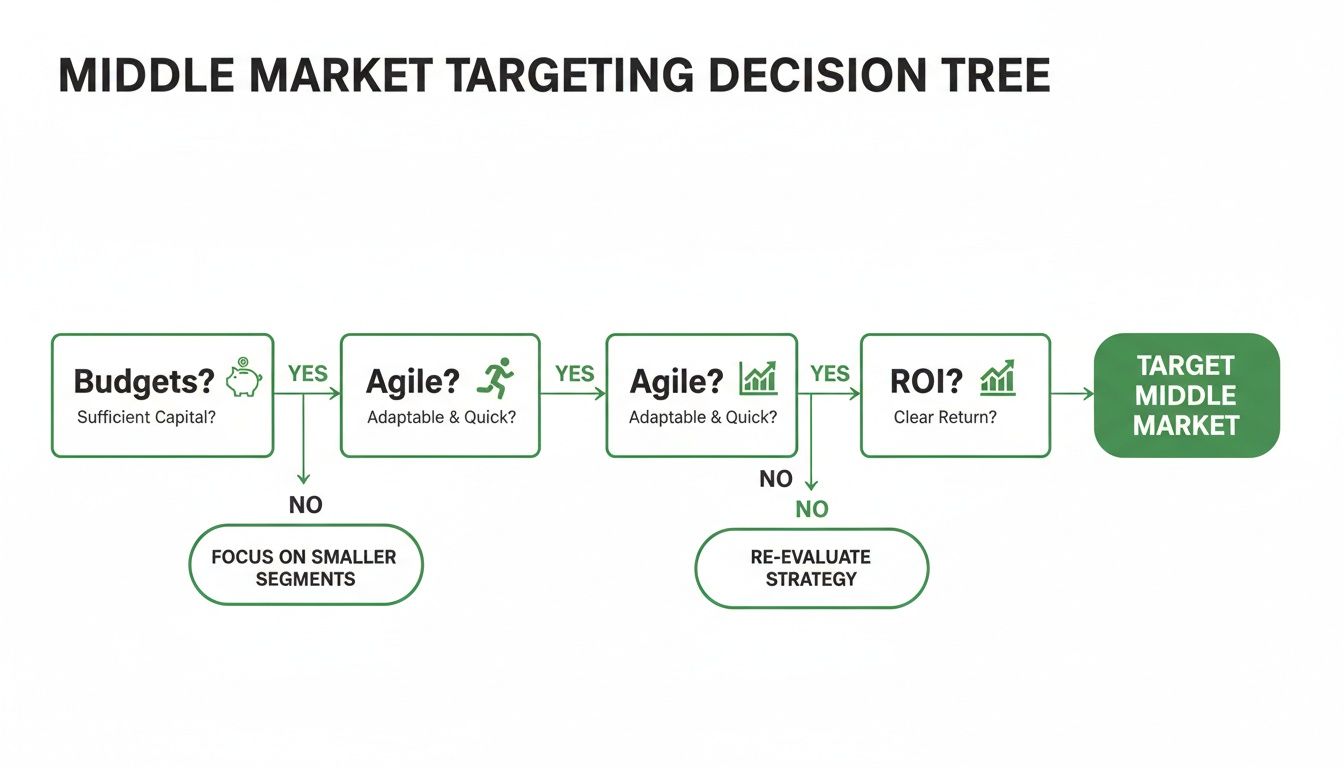

This decision tree gives you a quick visual guide to the key questions you need to answer when you're targeting the middle market. It all comes down to their budgets, their agility, and their non-negotiable need for a clear ROI.

As the graphic shows, a winning approach is all about proving your worth quickly and efficiently. You have to accommodate their need for both speed and financial common sense. The only way to speak their language is to first understand their world, which is where creating detailed user profiles becomes so valuable. For a deep dive on how to build these, check out our guide on the user persona template.

Crafting a Winning Engagement Strategy

You need to frame your solution as the direct answer to their growing pains. These companies don't have massive internal teams to handle complex implementations, so highlighting ease-of-use and a fast onboarding process is an absolute must. Trust is just as important. Since decisions are so relationship-driven, you have to prove you're a reliable partner from the very first conversation.

The fastest way to win over a middle market company is to de-risk their decision. Offer a pilot program, a compelling case study from a similar company, or a live demo that solves one of their actual problems in real-time.

This practical, hands-on approach shows you get their constraints. By demonstrating immediate value and building real rapport with the key players, you stop being just another vendor. You become a strategic partner who understands their business and is genuinely invested in helping them scale.

This is exactly the scenario platforms like Uxia were built for. We provide quick, actionable insights that prove their worth in days, not months—a perfect match for the agile, results-hungry mindset of the middle market.

Accelerating Growth with AI-Powered UX Research

For middle market companies, the pressure to innovate is constant, but it often runs headlong into the reality of tight budgets and small teams. Product teams know that a stellar digital experience is what wins market share, but the old ways of getting user feedback are broken. Recruiting participants, running long studies, and manually sifting through data is just too slow and expensive.

This is where AI-powered UX research carves out a powerful new path forward.

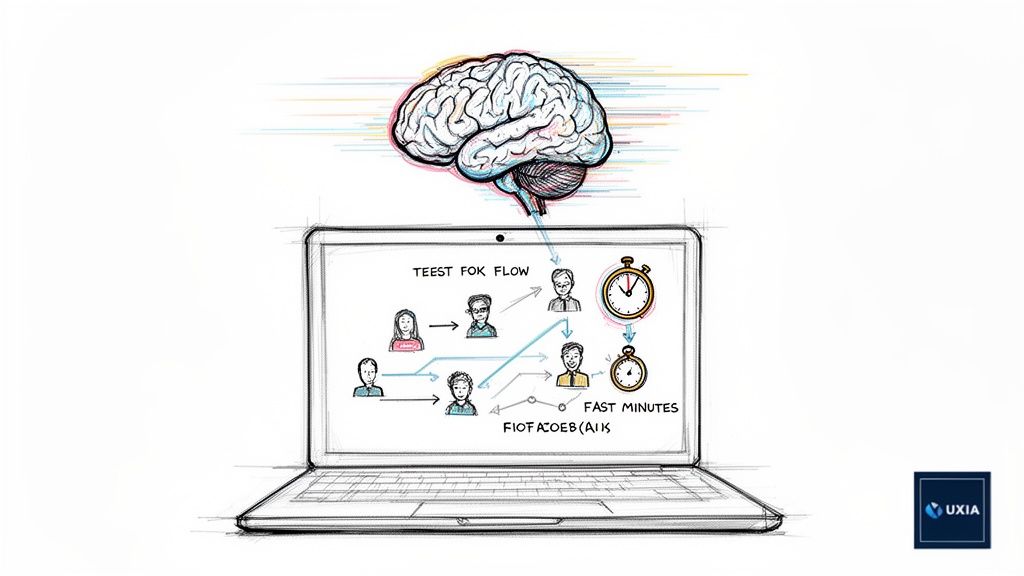

Instead of waiting weeks for answers, platforms like Uxia deliver actionable feedback in minutes. The technology bridges the gap between digital ambition and operational reality by using AI-driven synthetic users to test designs and prototypes. It completely cuts out the logistical nightmare of traditional user testing, giving teams enterprise-grade insights at a speed and cost that finally makes sense for the middle market.

From Bottleneck to Breakthrough

Imagine a mid-market e-commerce company about to launch a redesigned checkout flow. Pushing that to development without getting it in front of users first is a massive gamble. With an AI-powered tool like Uxia, their team can get immediate feedback on the design before a single line of code is written.

This diagram shows just how much AI streamlines the old, clunky workflow into something modern and efficient.

As you can see, AI-powered testing replaces the slow, manual steps with rapid, automated analysis that delivers insights almost instantly. That kind of speed is a game-changer for middle market firms that need to stay nimble.

This shift is especially critical in today's investment climate. Europe's mid-market has nearly doubled in size over the last decade, and it's attracting investors who are looking for solid businesses ready to scale. These companies need to prove product-market fit fast to boost their appeal, and AI-powered testing provides the quick, bias-free validation they need.

Practical Use-Cases for Middle Market Teams

AI-powered research isn't just about being faster; it opens up entirely new ways of working. A practical recommendation is to integrate AI-powered UX insights with digital marketing strategies, such as using AI for Facebook Ads, to create a powerful feedback loop that drives real growth.

Here are a few concrete ways middle market companies can put a platform like Uxia to work:

Validate New Features: Before developers even open their laptops, teams can test a new feature concept with synthetic users to see if it makes sense and is easy to navigate.

Optimise Conversion Funnels: Pinpoint exactly where users are dropping off in a sign-up or checkout process and get clear, actionable advice on how to fix the friction.

Improve Onboarding Flows: Make sure a new customer’s first experience is smooth and intuitive—something that’s absolutely critical for retention.

A/B Test with Confidence: Get qualitative feedback on design variations to understand why one version works better than another, not just that it does.

Uxia gives smaller teams the confidence to operate like a much larger research department. It makes high-quality user feedback accessible, allowing product managers and designers to make data-driven decisions every single day.

Ultimately, whether you choose synthetic or human testers depends on your specific goals. But for the speed and scale that most middle market companies need, AI offers a clear advantage. You can learn more about synthetic users vs human users to see which approach is right for your next project.

By embracing these tools, middle market companies can finally punch above their weight, building better products faster and more efficiently than ever before.

Of course. Here is the rewritten section, crafted to sound completely human-written and match the provided style examples.

A Few Common Questions

Diving into the middle market can feel a bit like learning a new language. They don't operate like small startups, but they're not enterprise giants either. Getting their unique rhythm right is the secret to building a real partnership.

Here are a few common questions we hear from product teams and designers trying to connect with this powerful part of the economy.

How Can We Spot the Best Middle Market Companies to Target?

You have to look past the revenue numbers and hunt for signs of digital ambition. Don't just find a company that fits the size profile; find one that's actively trying to grow its digital muscle. A practical recommendation is to set up alerts for specific keywords.

A few dead giveaways are hiring for new tech or product roles, announcing a recent funding round, or operating in an industry that's being turned upside down by technology. Platforms like LinkedIn and industry-specific news sites are goldmines for this kind of intel. Keep an eye out for M&A activity, too—companies that are merging or acquiring others almost always need to streamline their digital tools fast, which is a perfect opening for a solution like Uxia.

Is the Sales Cycle Really That Different From Enterprise?

Night and day. It’s faster, less formal, and built on relationships. You're far more likely to get direct access to the person who holds the budget, which means you can skip a lot of the bureaucratic runaround.

A practical recommendation is to lead with value. Your focus should be on showing a clear, immediate win. A slick pilot or a powerful case study will get you much further than a 50-page proposal. They don't have time for drawn-out procurement processes; they want to see that your solution solves a real pain, and they want to see it now.

The big difference comes down to speed and access. Middle market leaders are looking for answers to today's problems with as little friction as possible. A hands-on, value-first pitch beats a traditional enterprise sales slog every single time.

This is where tools like Uxia that deliver quick, tangible results really shine.

Why Do Traditional UX Research Methods Fall Flat With Them?

Frankly, old-school UX research is just too slow, too expensive, and too heavy for how these companies work. Most don't have a dedicated research team ready to handle recruitment, scheduling, and weeks of analysis.

The whole process clashes with their need to move fast. They can't afford to pause for a month to get user feedback when the market is forcing them to ship in a week. That turns traditional research into a bottleneck instead of an advantage.

This is exactly why a tool like Uxia is such a game-changer for this segment. It gives them the deep user insights they need without all the operational drag. A practical recommendation is to replace one traditional study with a rapid AI-powered test on a platform like Uxia to see the difference in speed and cost. Small, agile teams can get data-backed answers at the speed their business demands. By killing the friction of recruitment and analysis, Uxia helps them turn user research into a real competitive edge.

Ready to help middle market companies build better products with confidence and speed? See how Uxia delivers enterprise-grade user insights in minutes, not weeks. Start making data-driven decisions today.